Turbulent oil market affecting the tanker market

The new Coronavirus, COVID-19, continues to paralyse the world. The virus is spreading rapidly – with enormous consequences for society as a whole. The oil and tanker market is now also in the midst of a major drama. Just a day or so ago, the oil price was down below $25/barrel, the lowest in 18 years. This in turn sent rates soaring in some parts of the tanker market.

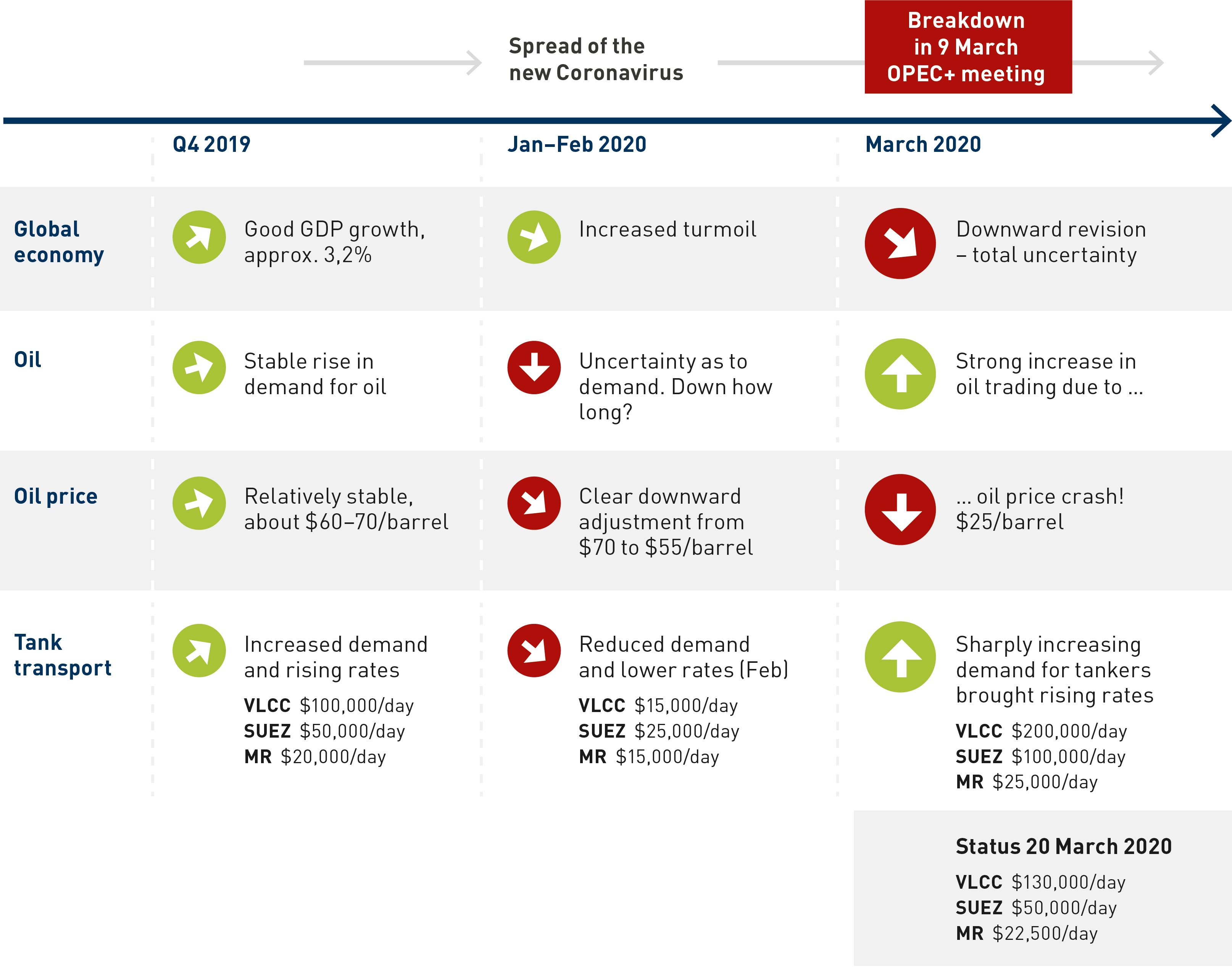

In the last 10 business days, we have seen how quickly conditions can change in the tanker market. In a short space of time, rates in the VLCC segment shot up from around $25,000/day to $ 200,000/day. In the Suezmax segment, rates rose to $75-100,000/day, depending to some extent on geographical area. Aframax tankers, which are smaller crude oil tankers used for shorter distances (North Sea/Middle East), went up to about $60,000/day. Rates also went up in the product segment – MR to $25-30,000/day and the large product tankers (LR1&2) to $35-45,000/day. In recent days, the rates have fallen back from the hyped-up levels and now lie at around $130,000/day in the VLCC segment, $ 50,000/day in the Suezmax segment and $20-25,000/day in the MR segment.

Lack of agreement within OPEC+

Behind the developments is an oil price in free fall. Since the turn of the year, the oil price has gone from about $70/barrel to $25/barrel, and lies at $30/barrel today, 20 March. The sharp decline is a result of concern about the consequences of the Coronavirus on demand and the failure of OPEC+ to reach agreement on the recommended additional production cuts. At the OPEC+ meeting on 6 March 2020, Russia opposed the proposal, which resulted in Saudi Arabia, very unexpectedly, abandoning its production cuts and instead opting to increase its market shares through sharply reduced prices to its customers. The result was an overnight slump of 30 percent in the oil price, the largest decline since the United States fought back against Iraq and joined the Gulf countries in the 1991 Kuwait War. And the downward trajectory has continued.

With an oil price of around $25-30 per barrel, private and state oil companies in the consuming countries could not resist starting to stock up, as was also the case for the more speculative buyers (e.g. trading companies) who buy oil, place it in storage, arrange forward sales and deliver physically later. The result has been a substantial increase in demand for trade in oil and therefore for tankers. A large part of the increased oil volumes will probably be stored, but some will go to refining and may thereby continue to contribute to increased demand for product tankers. These factors are all a result of the crash in the oil market.

Unpredictability in the longer term

In terms of supply and demand, we were moving towards a strong structural upturn in tanker shipping. Then came the latest development, quite unpredictably, as a result of the Coronavirus. Just as unpredictable was the strong market upswing – as a result of the total oil price crash. The market may therefore remain relatively strong in a shorter perspective, but for completely different reasons than we previously predicted. It is not possible to assess market development in the longer term as no-one knows the full effects of the Coronavirus.

At concordiamaritime.com, we will continue to provide regular updates on the market situation. Follow us there.

Kim Ullman

CEO, Concordia Maritime AB

Oil and tanker market development, Q4 2019 to present

(click the diagram for a large version – opens in a new window)